- Analytics

- Market Overview

Further rally in global stock markets - 26.10.2015

On Friday the US dollar index and stock market continued upward movement due to the positive earnings reports from the companies and macroeconomic statistics. The U.S. October manufacturing PMI by Markit exceeded forecasts. The quarterly earnings from Procter & Gamble were positive and its stocks climbed 2.9%. Nasdaq Composite added 3% in a week, Dow Jones - 2,5% and S&P 500 - 2,1%. Due to this, S&P 500 added 0.8% since the start of the year. The market participants believe the gross earnings reduction of S&P 500 components will be 2.8% instead of previously expected in the end of September -4.9%. The trade volume on the U.S. stock exchanges was 4% higher today than the average of 20 sessions amounting to 7.6bn stocks. Today at 15:00 CET the U.S. September New Home Sales will be released. In our opinion, the tentative outlook for dollar is a bit negative.

The European stock indices kept growing today. The German IFO business climate indicators were better than expected. Today no more significant data is expected from the EU. The Philips stocks lost 2% despite the positive reports. The company’s representatives said the $3.3bn deal on the sale of the affiliated light bulbs producer Lumileds can fall through because of the US officials disapproval. The euro continued weakening against the US dollar amid the expected expansion of the ECB monetary emission.

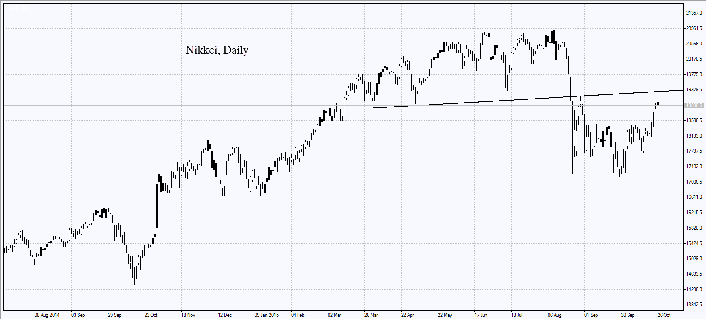

The Nikkei index was on the increase in line with other global stock market indices hitting a fresh 2-month high. The Hitachi and Panasonic stocks showed significant price growth as markets expect positive accounts from them. The JPY/USD pair is slightly strengthening today after weakening significantly for 7 days.

The Bank of China cut the interest rates for the 6th time since last November in order to support the national economic growth. The move followed the ECB announcement of the possible further monetary policy easing. This week the Bank of Japan, New Zealand and Sweden meetings will take place where policymakers can follow the steps of their colleagues.

The commodities futures have slightly risen in price. Investors believe the cut rates by the Bank of China will provoke the increased demand for commodities due to the Chinese economic recovery. In particular, the copper prices increased. Apart from the lowering of the rates in China, the reduced forecast of the copper production in Chile for the 4th time since the start of the year to 5.68mln tons contributed to this fact, the state agency Cochilco reported.

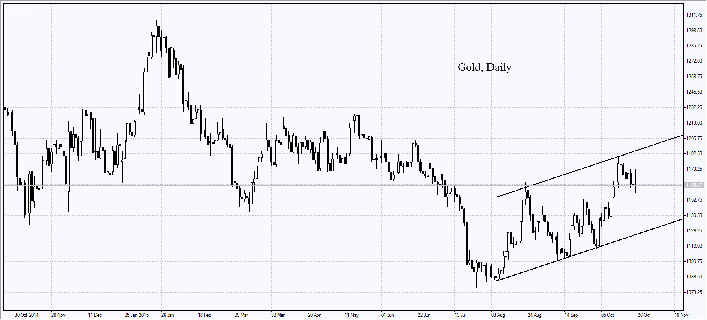

The gold prices has slightly increased today. The SPDR Gold reported a $950mln inflow since early August. Nevertheless, Goldman Sachs bank expects the gold prices to fall to $1100 within 3 months, to $1050 — within 6 months and to reach $1000 within 12 months. According to the US Commodity Futures Trading Commission, the net long position in gold on COMEX reached the highest since February 2015 and in silver – the highest since July 2014. Precious metals are yet in strong demand. The Indian Prime Minister Narendra Modi announced the gold monetization programme. The opportunity to deposit metal in Indian banks at interest will be introduced.

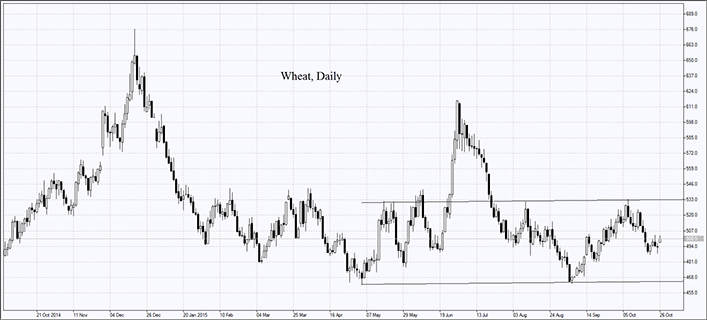

Wheat prices went up after the drought was forecasted in the U.S. Meanwhile, according to the US Commodity Futures Trading Commission, the large net short position in wheat is held on CBOT. It is hard to predict now where the grain prices will go but the higher volatility is possible.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also